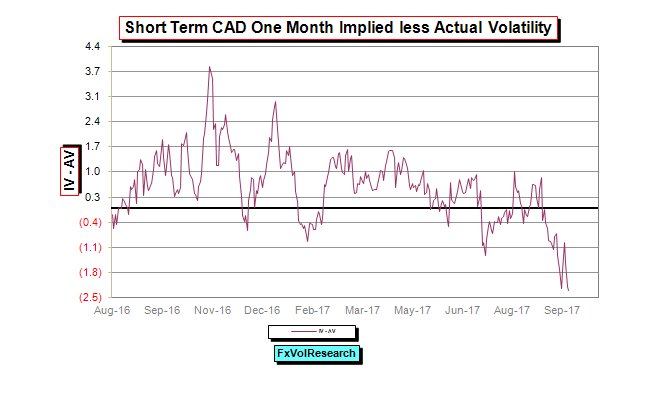

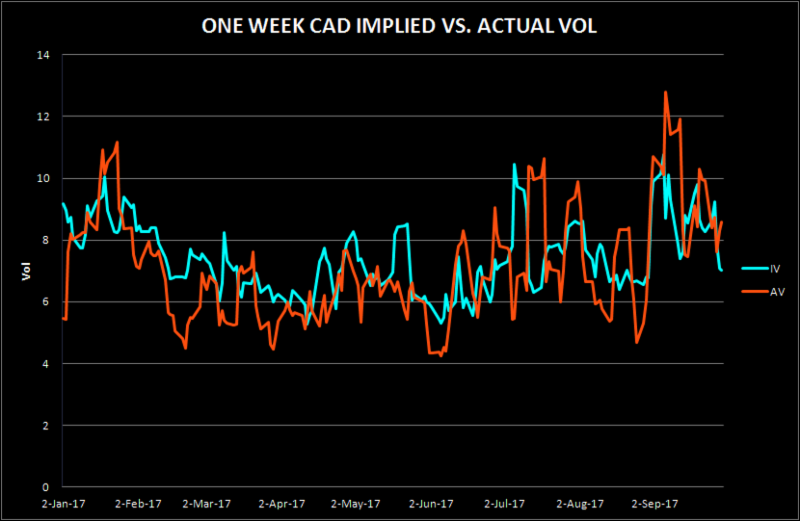

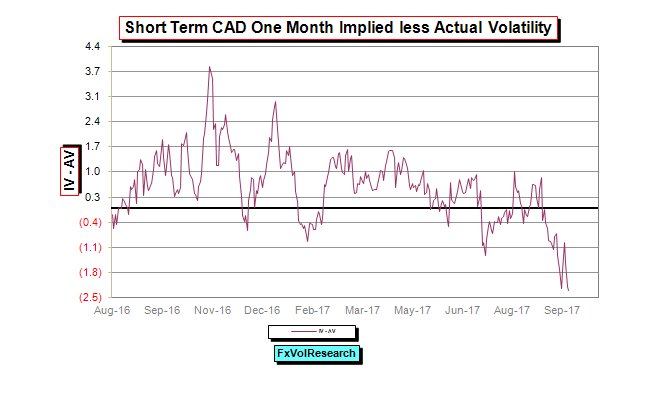

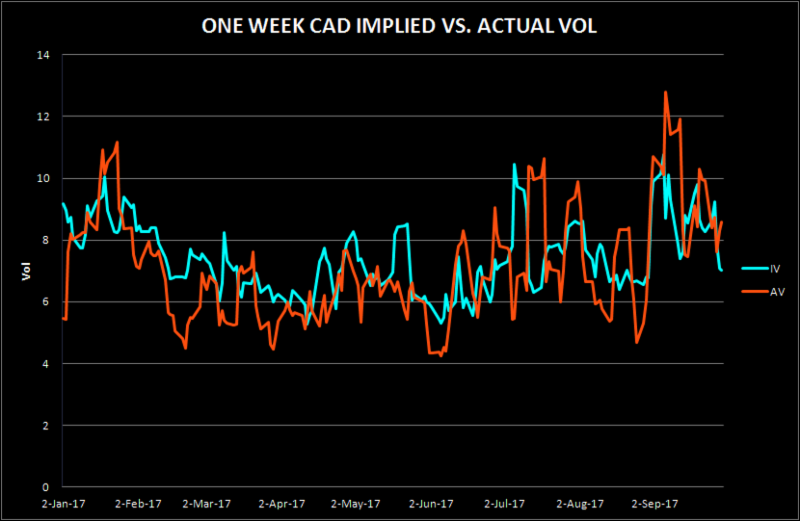

One month CAD$ implied volatility is trading too far under the actuals. This applies to the short dates as well.

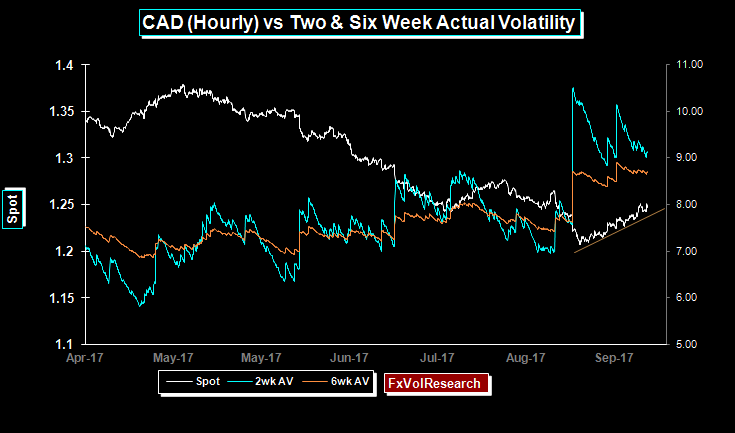

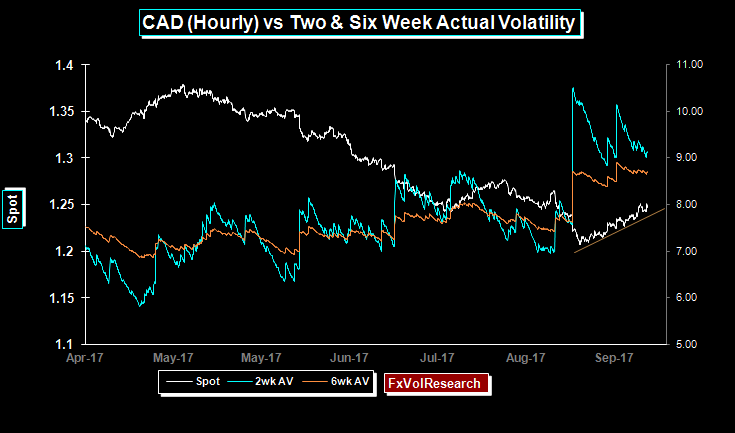

The short dated actuals are trading well above the implied volatilities of the short dated CAD options with the two week closing near 9%.

Above is the CAD one week implied vs. actual chart. As you can see last week the realized vol rose (AV) while the implied ended the week lower. The market seems to be assuming a strong period of consolidation ahead, but in our view it is too early sell the short dates. While the weaker than expected GDP did encourage the US$ over 1.2500 it did not stay there for long and ran into strong selling interest.

While we are of the view that the C$ is more likely to correct back to 1.3000, the evidence of the weaker than expected GDP report is not enough to suggest that the BoC will be on hold for the rest of the year. While 5YR bond spreads moved back in favour of the US this week, 2YR yield spreads are still marginally positive for CAD. We need that spread to flip as well to provide the spot with a firmer footing over 1.2500.

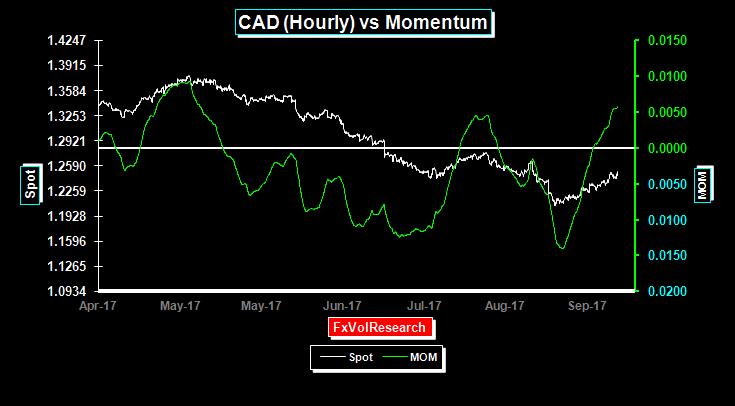

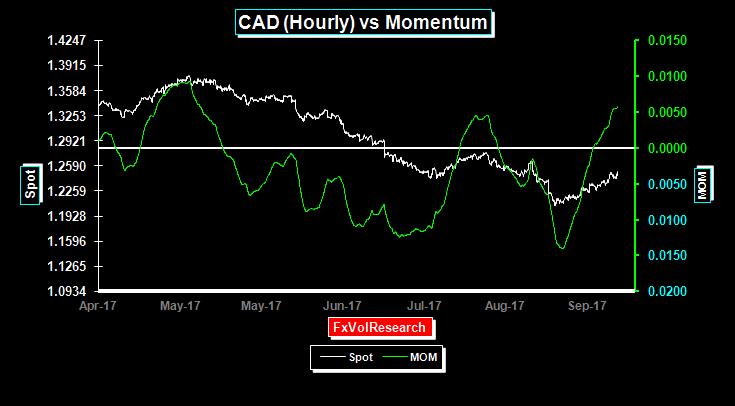

CAD momentum has moved again into positive territory. However, our short-term indicator of spot vs. Vol correlation has not moved higher at the same time. These mixed signals suggest to us that this period of CAD strength is not yet entirely finished.

Canadian Sept Employment data is due next week and it tends to be subject to significant revisions. The market will be looking at the full-time employment component.

Similarly, the US data out at the same time will be considerably impacted by the effects of the hurricanes and it will take months before the US employment data starts to normalize.

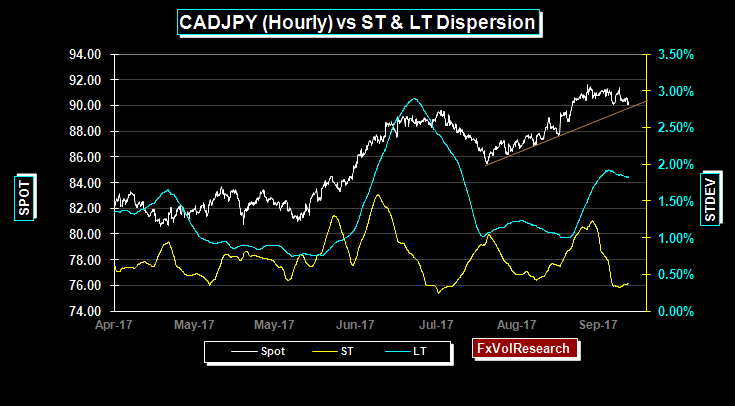

CAD/JPY is showing tentative signs of rolling over and potentially testing the hourly trend line.

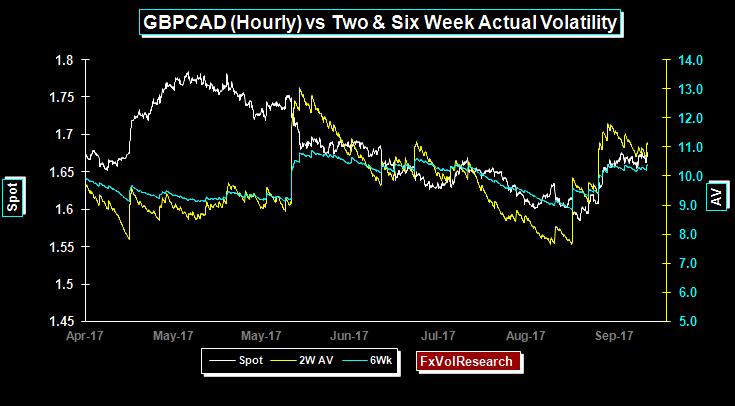

GBP/CAD is also too low in one month and short dates in relation to the actuals. Both one and two week GBP/CAD is quoted under 8%.

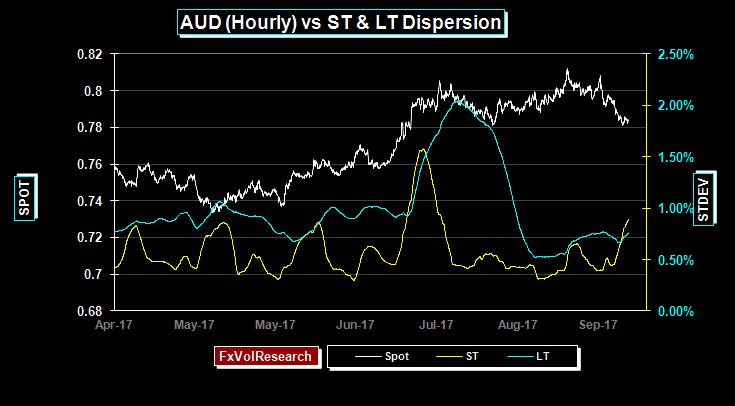

The AUD$ continues to trade heavily and now with the ST dispersion rising additional trending price action is likely. Should support at 78 gives way a further decline to 76 is likely. Conversely, any move back over 80 cents should be sold on LT directional basis.

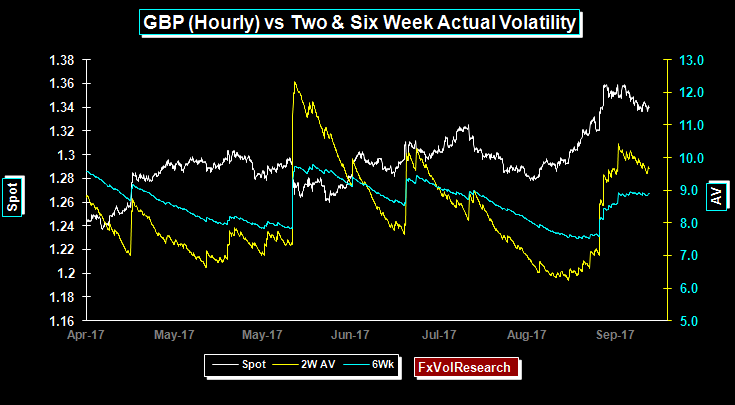

GBP/USD short-dated options are also cheap in relation to realized vol. Following May’s speech in Florence, there was a short-term improvement in sentiment around Brexit holding out the prospect of more substantial negotiations with the EU27. This sentiment may well be proved short-lived if she cannot carry the hard-line Brexiteers at the forthcoming Conservative party conference.

The deterioration in the UK’s current account did not help sentiment either. GBP did get some near-term support form Carney’s hints of earlier than expected rate hikes. Three-month GBP implied vol was sold off to approx the 8% level and is now in line with the actuals. We remain of the view that GBP vols are unlikely to trend that much lower and will once again represent excellent value if the IV-AV spreads turn negative and the implied vols trade back to the mid 7% level.

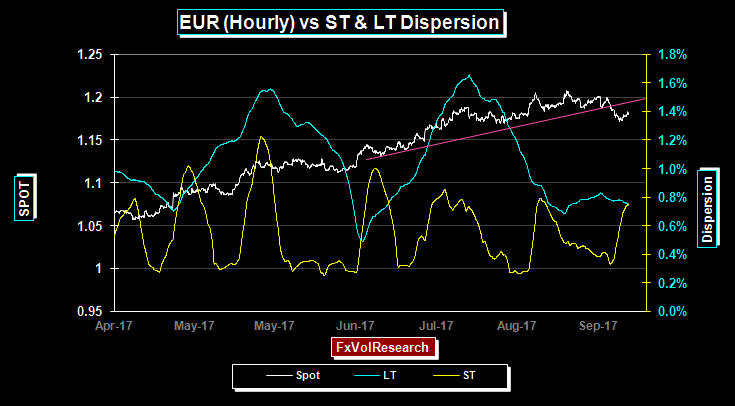

LT hourly EUR dispersion is trending lower however the short term indicator is trending higher and may break over the LT indicator. Should that occur it will increase the odds of a near term trend developing. The spot is still below the hourly trend line and EUR momentum and other indicators are bearish.

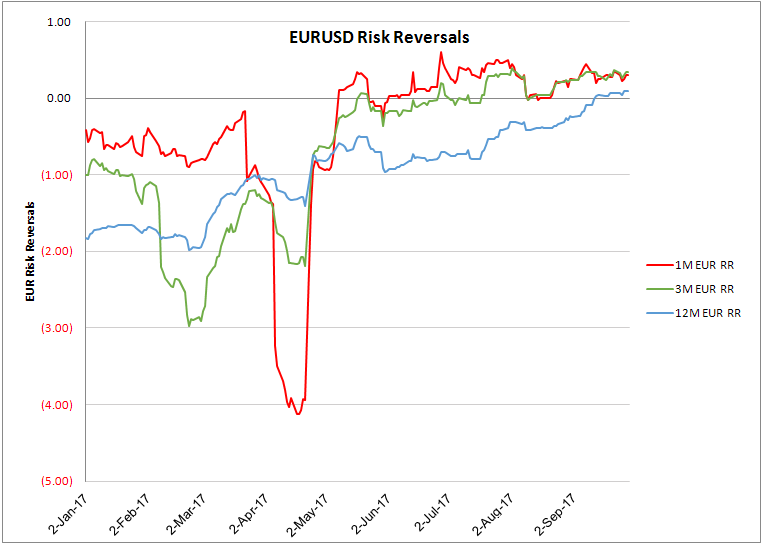

What is a bit surprising is the lack of follow through in terms of selling of the EUR risk reversal? Despite EUR failure to hold over 1.2000 EUR risk reversals continue to move better bid for EUR calls over puts. Particularly notable is the one-year maturity that is persistently better bid. The market makers are still short out of the money calls.

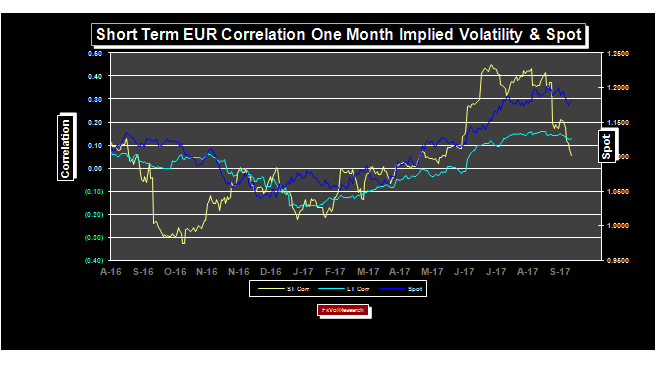

Short term EUR spot vol correlation is trending lower. The take away from this is that the EUR upside is limited in the near term.

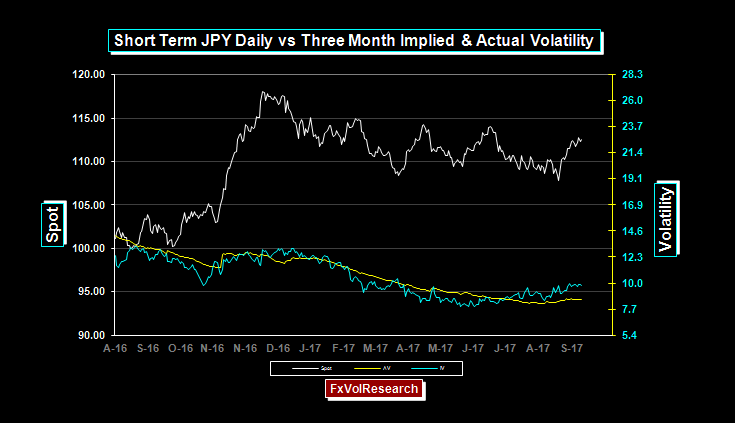

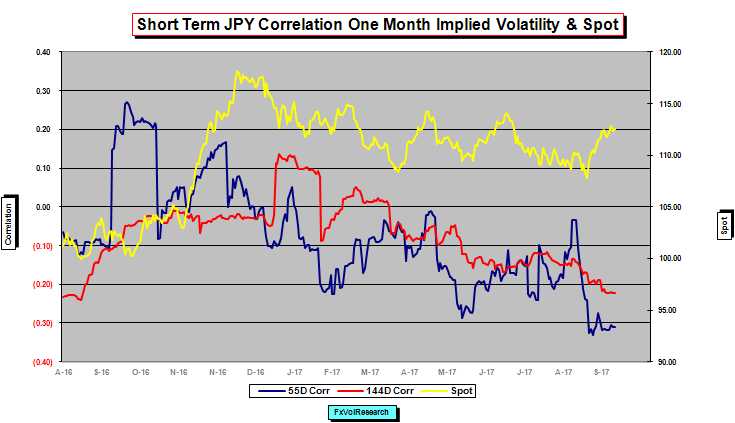

Yen vols remain better bid compared to their G10 counterparts with implied yen volatilties now well over the actuals.

The short-term correlation of implied vol and spot are lower, potentially a US$ negative signal as implied vols rise while the spot tries to trend higher. This is contrary to the market’s consensus view that the BoJ will continue to glide the US$ higher, and that the forthcoming Japanese election will not have a material change in monetary policy.

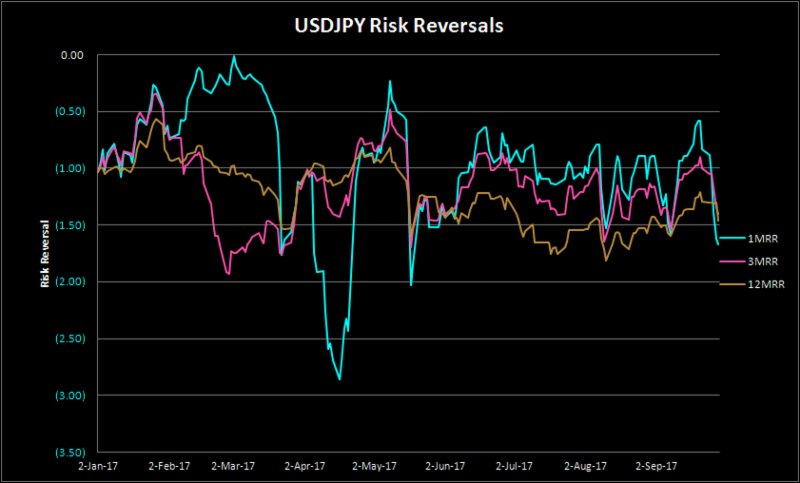

Premiums for Yen calls rose across the board last week not only vs the Dollar, but also GBP/JPY, EUR/JPY and CAD/JPY.

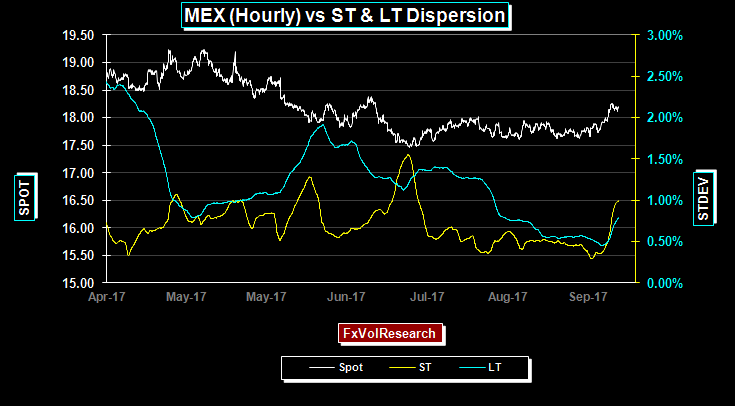

MXP dispersion is finally starting to rise while implied vols remain offered. The odds are now high with the spot breaking out above 18 that MXP premiums should start to pick up for the 10% level in the 3-months. The MXP curve has been the best value in our database for most of this year.