Following the latest data from the United States – Friday’s report of inflation, dollar jumped against all of its major counterparts, leaving enough steam for the currency on Monday’s Memorial Day session.

Another factor helping the US currency came from the eurozone, when Greek policymakers informed about the inability to provide International Monetary Fund (IMF) repayment, undermining euro’s strength.

Boost for the US dollar came on Friday from the Bureau of Labor Statistics as the core inflation showed 1.8% annual acceleration, the same as in previous month, but not slowing down as previously expected, and on monthly basis we could see the gauge quickening by 0.3%.

After the latest Federal Open Market Committee (FOMC) minutes, when policymakers officialy resigned to June’s liftoff, these data helped to strengthen the already hit sentiment by the rate-hike postponement, and boosted the dollar, erasing large portion of its previous losses against the euro, as well as against most of its major peers.

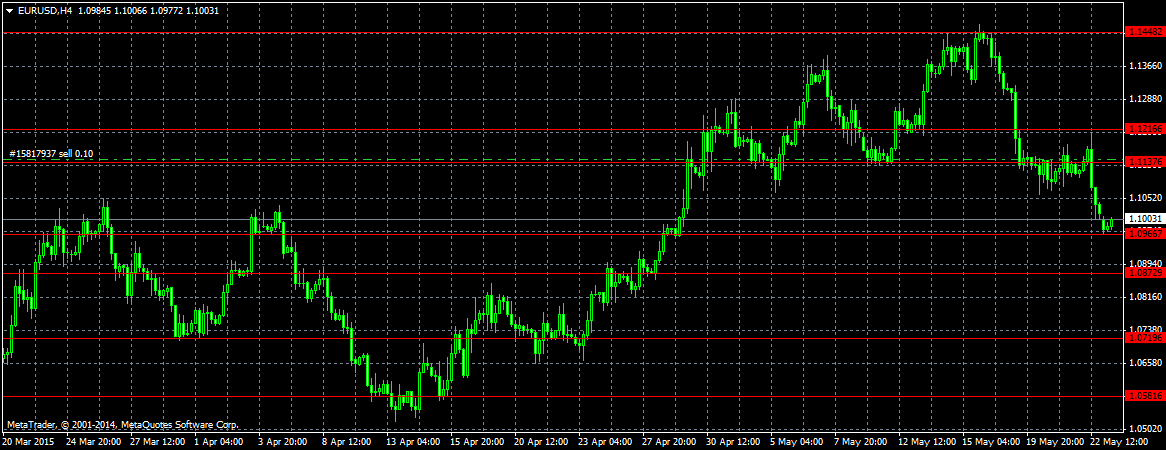

From the technical point of view, our previously hinted support level at $1.0966 has been hit already today and the pair is getting closer to the $1.0719 level and $1.0491, set as mid-term take profit level.

If any short-term data or events boost the euro or undermine the dollar, we can expect the pair to reach resistance level at $1.1216.

For any questions of recommendation, feel free to write us on hello@goforex.eu