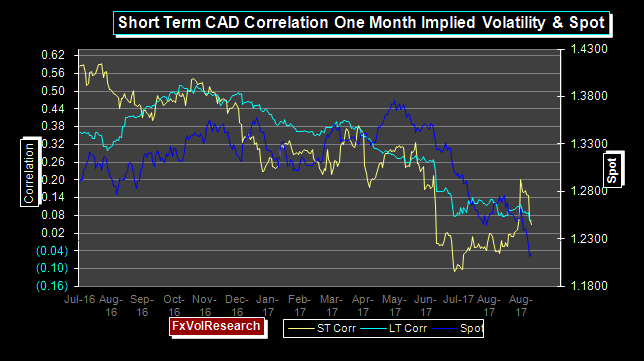

The short term correlation of one month IV and spot that we pointed out last week as a leading indicator of a potential USDCAD bottom has reversed this week suggesting more sustained C$ strength. The BoC decision to raise rates again was unexpected as it took place without any press conference. The BoC has now removed the 50bp cut they implemented in 2015 following the oil price collapse. If the Canadian economy really is on course to grow in excess of 3% or more further rate hikes are on the cards. However, that is, at this point a bit of a reach. In order for that to happen, we would have to have a global growth outlook that is accelerating & further improvements in the commodity complex.

No doubt, we have seen a sustained commodity price correction, however, it is still too early to support the view that we are in a long term commodity price expansion. Copper made a new high at 3.15 but on Friday came off sharply to close just over 3.03. WTI has also failed to break over the key 50$ level. The DJ Commodity index has proven more resilient and ended the week only slightly below the key 590 level. Finally, short term 2 YR CAD-USD yield differentials are now positive and in this environment, the C$ downside is going to be far more limited. Equities generally rally in the early stages of a tightening cycle. So far, the TSX reaction has been muted at best. If rates rise further in Canada, particularly in the context of the Federal Reserve staying on hold, that could prove to be a policy mistake if the “synchronized global growth” story is not nearly as resilient as the BoC believes.

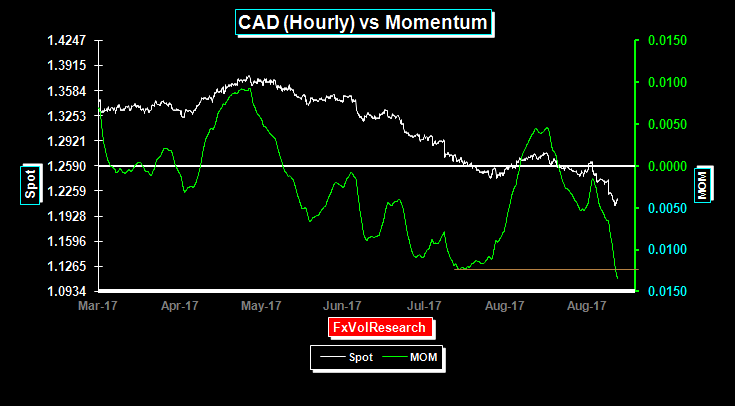

CAD momentum makes a new lows on last weeks price action. At minimum the spot needs a period of consolidation to relieve the extreme negative momentum readings. On a percentile basis one week CAD implied vol is expensive.

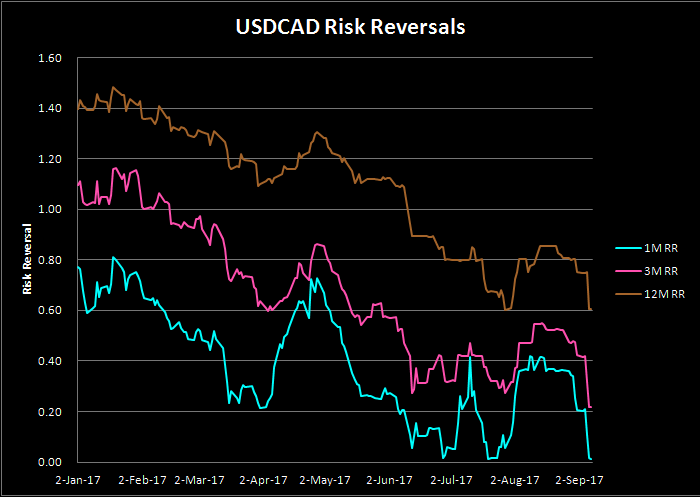

CAD Risk reversals again declined in line with the spot but they did not flip in favour of CAD calls over, but as you can see from the chart the three month reversal made a new high (less premium for CAD puts). The one month ended at flat while the one year went back to its previous cyclical low. However we may well be at an important inflection point.

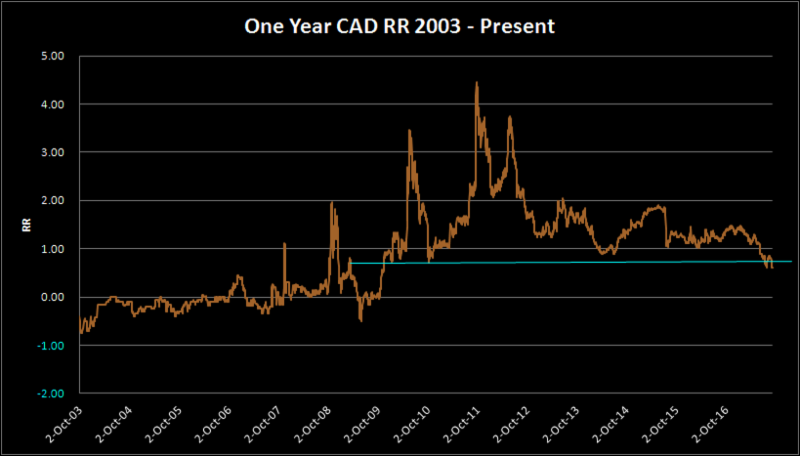

Above is the one year CAD risk reversal going back to 2003. As you can see the one year reversal has traded at levels lower than we are now, but those periods corresponded to periods of sustained C$ appreciation.

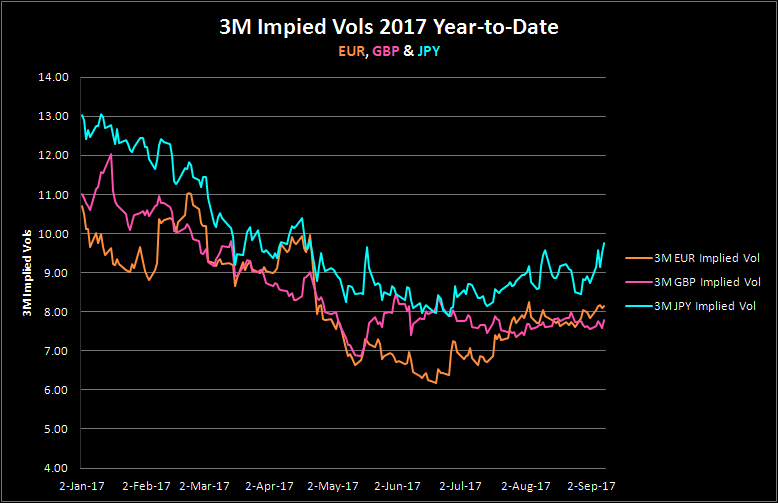

Implied vols continued to slowly rise last week with the Yen main driver higher.

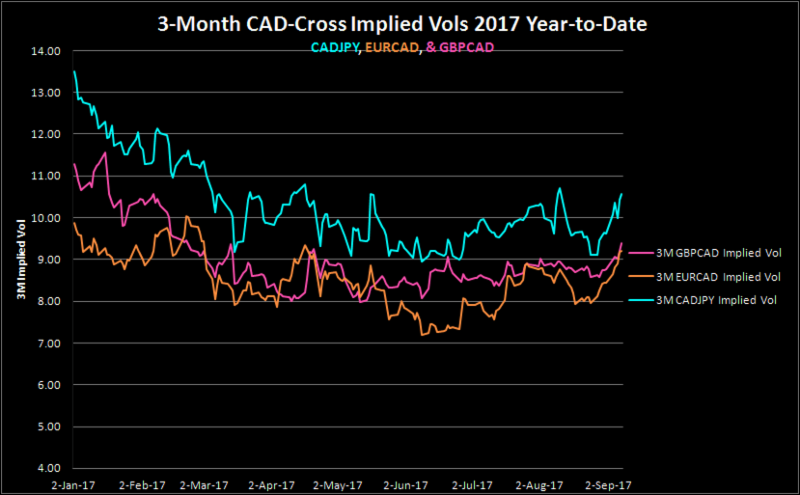

CAD Cross vols followed in sympathy with GBPCAD now at nearly 1.6% spread higher than GBPUSD. A new 2017 high. Short date EURCAD is also expensive on a percentile basis as well as the one month.

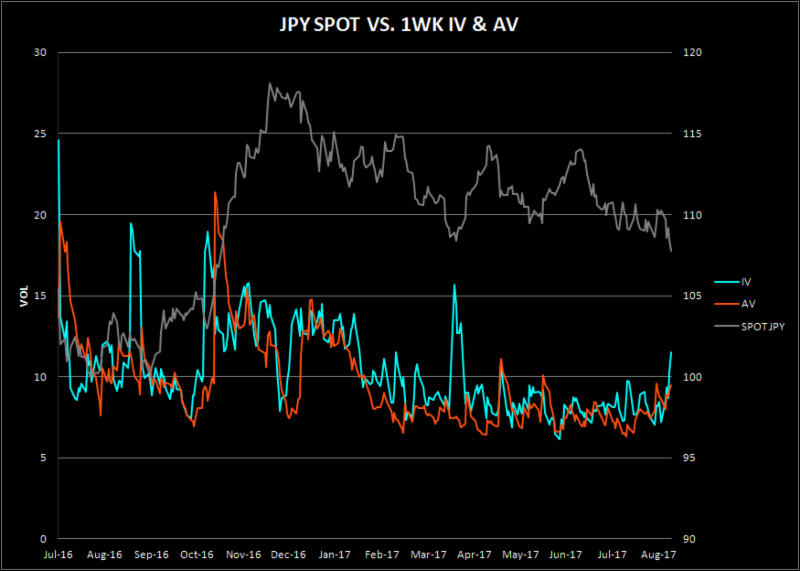

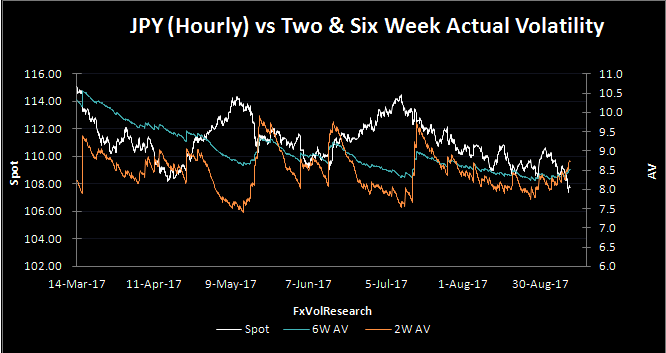

With $-Yen threatening to break lower, short dated yen premiums ended the week bid. Implieds ended the week well over the actuals.

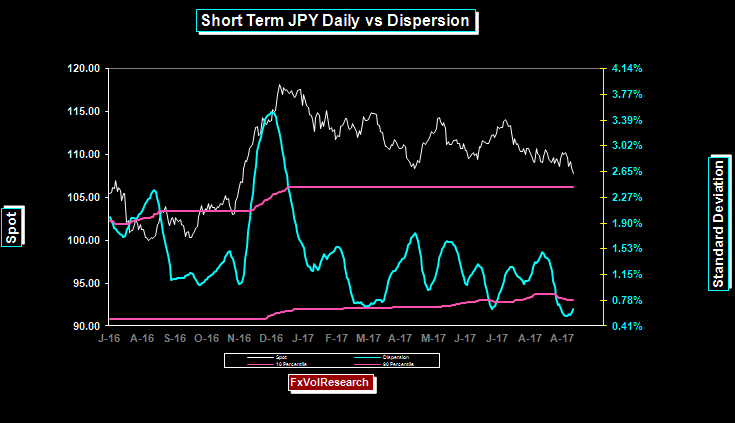

Yen dispersion is rising from a major low. The odds of more trending price action is high. After several false starts the Yen may now be finally breaker down in line with the general Dollar sell-off.

Two week actual yen vols rise over the six week. For most of the summer months yen actuals have been trending lower and this may be a sign of an important inflection point.

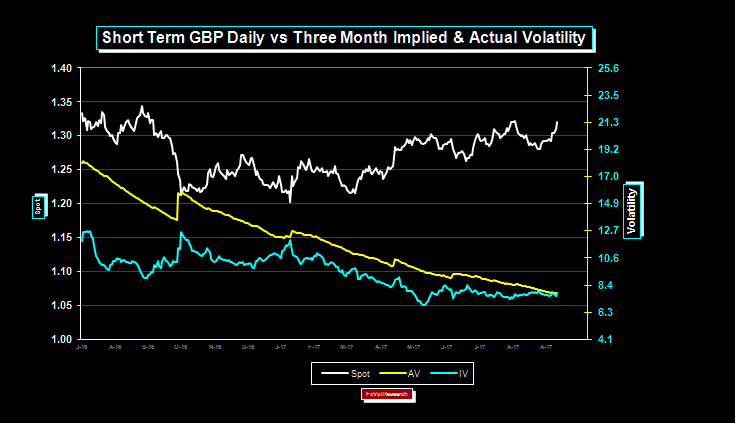

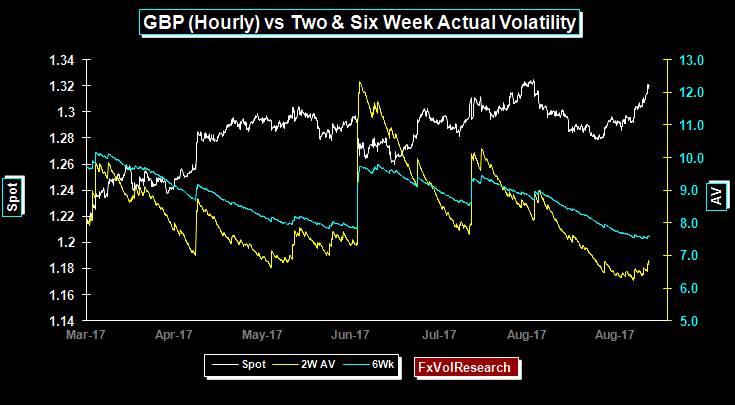

While short dated GBPUSD vols remain bid the the rest of the curve remains subdued. As the chart above indicates the spread between the actuals and implieds is nearly back to flat. The least expensive 3-month options in our data base are MXPUSD followed by GBPUSD.

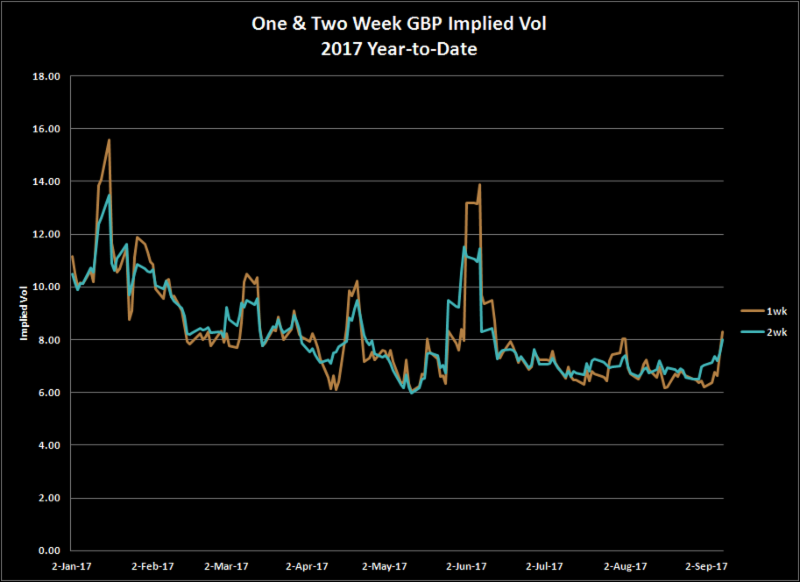

One & two week GBP implied ended the week bid.

GBP actuals are turning up but are lagging behind the implied curve as short dated premiums remain better bid.

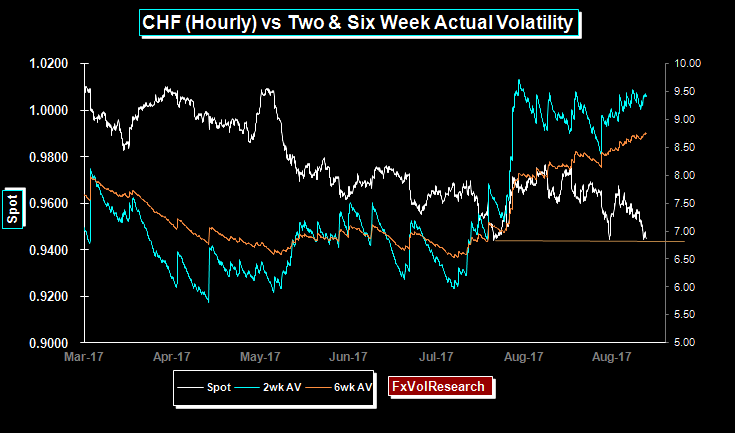

Spot CHF is threatening to take out the hourly support above 94. CHF actuals remain elevated in the choppy price action. One week CHF is expensive particularly in relation to the spread over the EUR.

Spot CHF is threatening to take out the hourly support above 94. CHF actuals remain elevated in the choppy price action. One week CHF is expensive particularly in relation to the spread over the EUR.

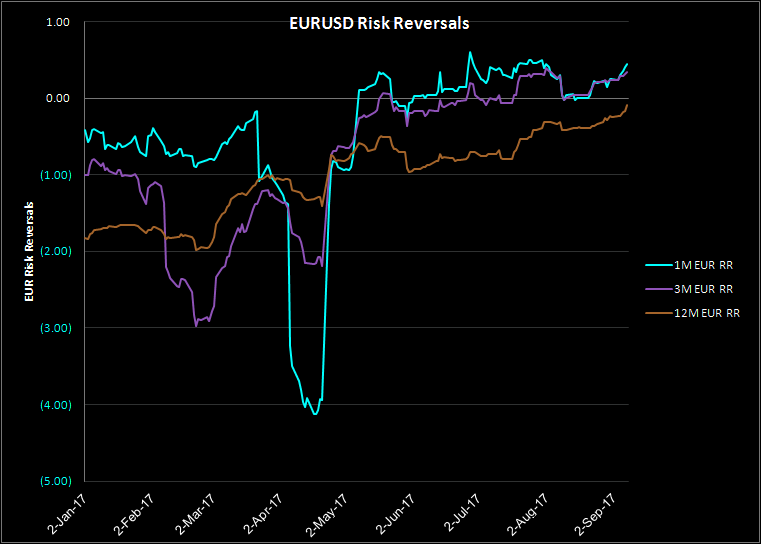

EUR Risk reversals moved better bid for EUR calls over Puts, with the one year nearly at par.

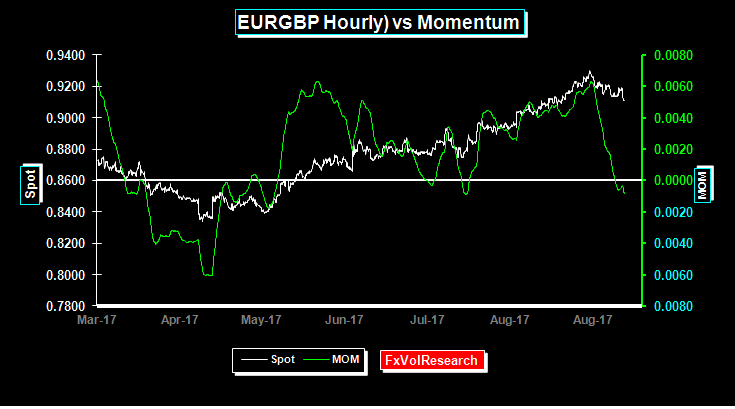

EURGBP momentum moves into negative territory. EURGBP could still be in a long term uptrend even with a further correction back to 90. The Brexit debate may well move to the back burner if the UK agrees to an interim agreement with the EU, basically keeping the UK in the single market until 2022.

In that outcome, a lot of uncertainty would be removed from the business environment and GBP may well be able to muster a more sustained rally. However, this outcome would still have to overcome substantial objectives within the Tory party.

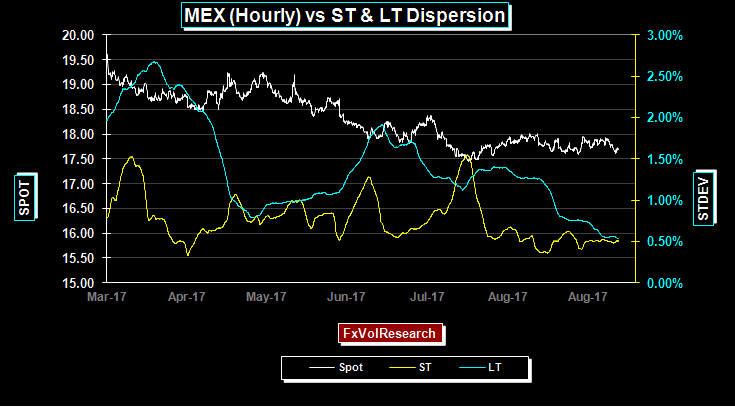

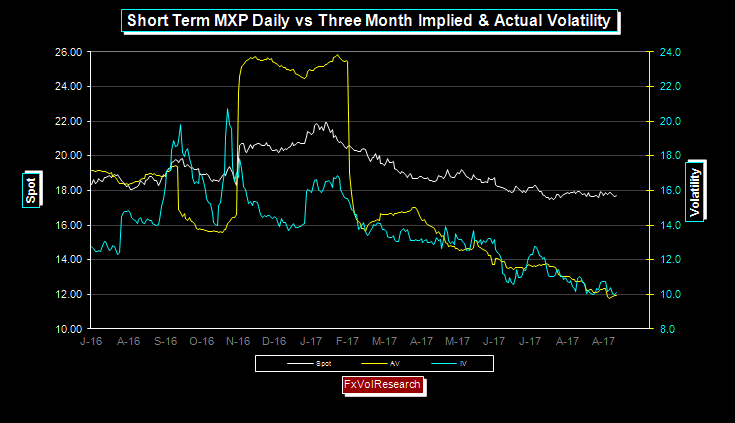

MXP vols are still trending lower as represented in the persistent decline in the MXP dispersion indicators. We may well be coming to the end of the sideways price action.

MXP implied vols continue to drift marginally lower with the premium levels in line with the actuals. The MXP curve remains cheap in accordance with our percentile models.

Source: James Rider – http://bit.ly/2gX2MER