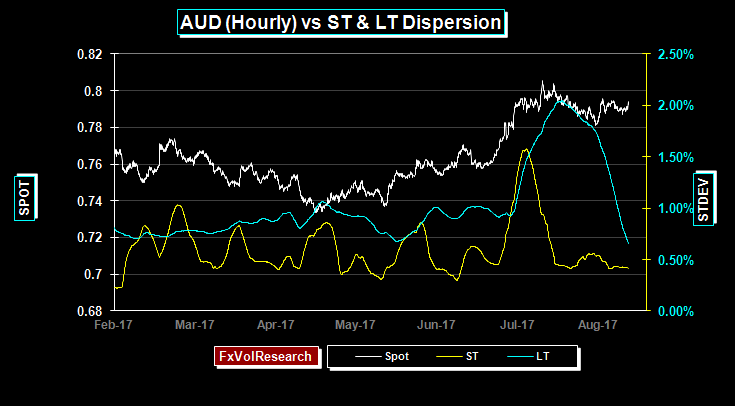

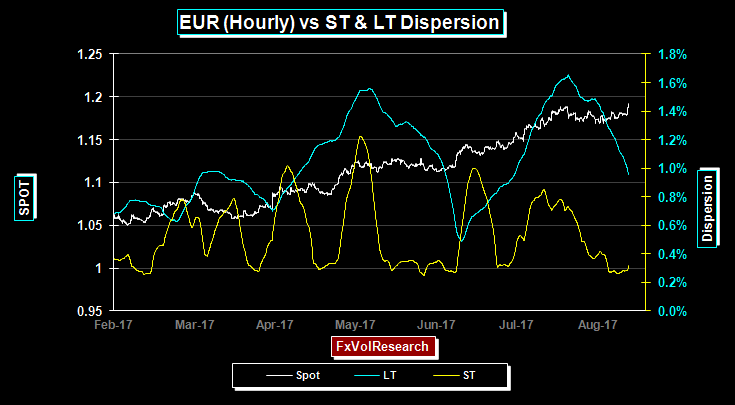

As we suggested the AUD has not yet topped out and remains in a consolidation pattern, confirmed by the persistent decline in the hourly dispersion indicators.

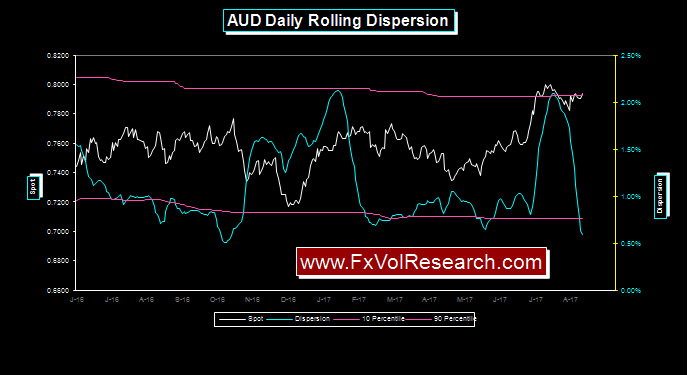

Above is the same Dispersion indicator but looking at daily data rather than hourly. While below the 10percentile ranking it suggests that the consolidation pattern is still well intact. A strong indication of this pattern coming to an end will be observed first in the hourly dispersion indicators and confirmed in the daily stats. Both CAD and AUD are getting support from the general Dollar sell off that was part of the overall FX story at the end of last week. With Yellen not making any comments on monetary policy US bonds rallied and interest rate differentials became less Dollar supportive.

Finally, the commodity complex remains bid, but without any signs of an impulsive move up. Copper closed over 3$ on Friday — another strong indication that the synchronized global growth story remains intact. However, a note of caution is warranted. The discount in the front end of the copper curve to the three-month delivery is at the widest discount in four years indicating ample short term supply. Copper is also being supported by speculative positioning and less by underlying demand so the current bullish sentiment could unwind quickly. Both AUD and CAD tend to be supported by global reflation and the knock on positive implications for the commodity bloc.

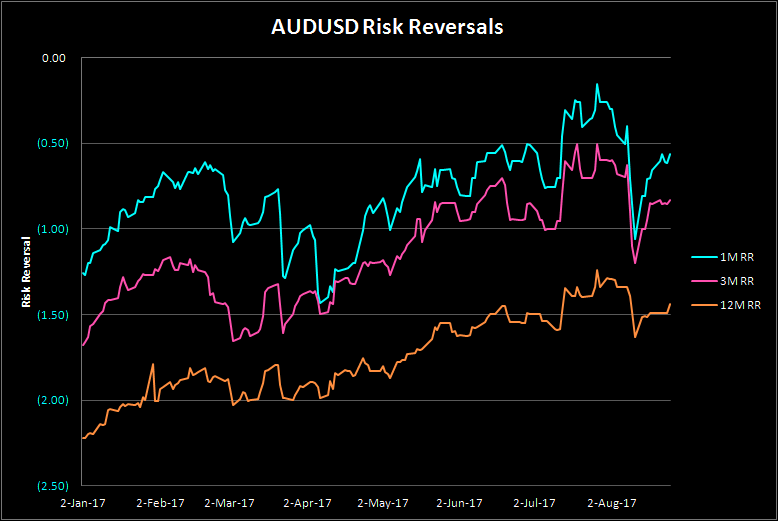

The AUD risk reversals have moved higher over the week in line with the move in the spot. Using percentile rankings AUD risk reversals are now cheap, or to be more specific, AUD puts are not overpriced in relation to AUD calls across the curve. Hedge based strategies that involve buying the skew should be favored by hedgers.

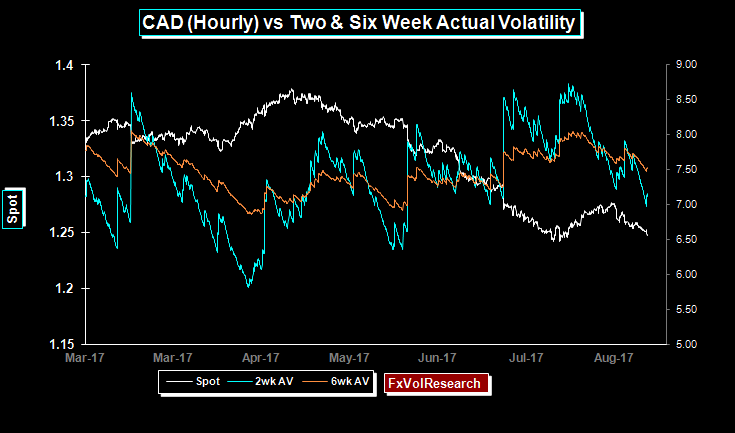

CAD short term actual vols fell further and faster than we anticipated but as you can see from the chart above the two week actuals are now well under the six week. Like the AUD, CAD is getting support from the positive tone in the commodity complex, and also from the further narrowing in US-CAD bond spreads. The CAD curve moved lower with the three month IVs testing the 7% level. The next level of support in the 3M bucket is the 6% level. We continue to favour trades that are short vol, and bleed shorter C$ over time, looking for a slow correction back to 1.33 by DEC.

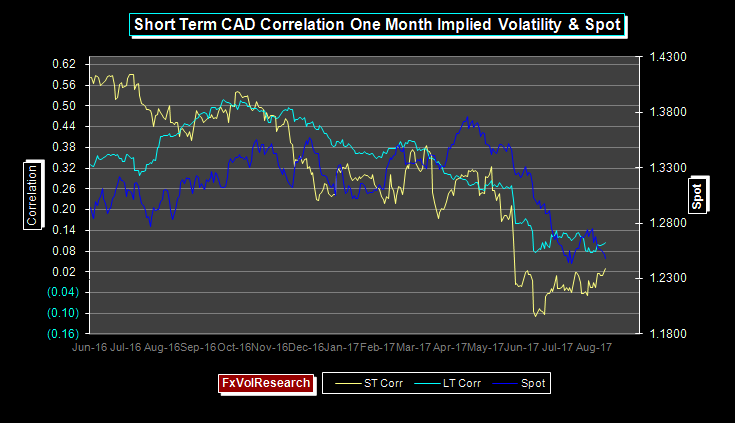

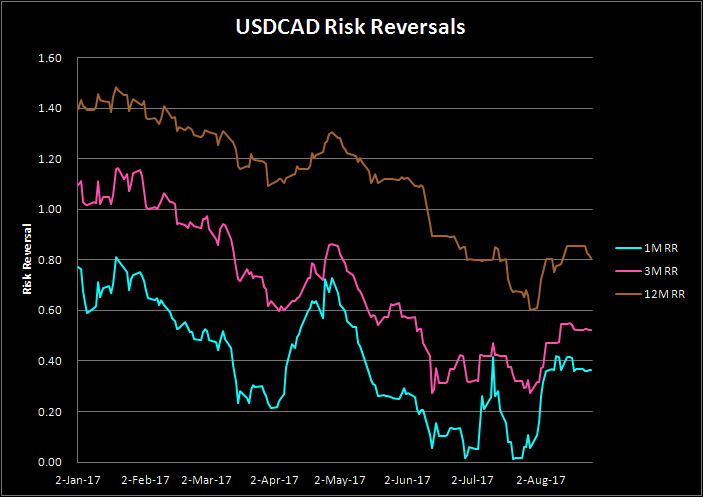

CAD spot vol correlation continues to move slowly higher suggesting that further sustained upside in the CAD is unlikely for now. This is also confirmed in another context but the risk reversals below.

With the C$ closing the week over 80 cents, it might have been a reasonable assumption that risk reversals would move better bid for CAD calls. That was not the case in the front end, however the one year lost a smidgen of premium for CAD puts. The market is naturally long CAD calls and this acts as a mild dampening effect on further impulsive C$ gains.

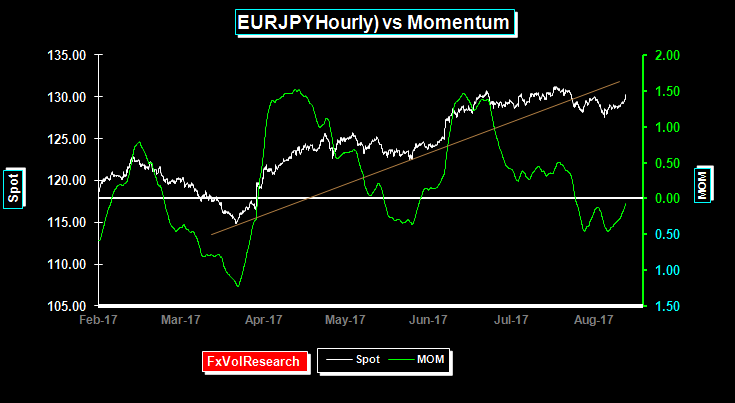

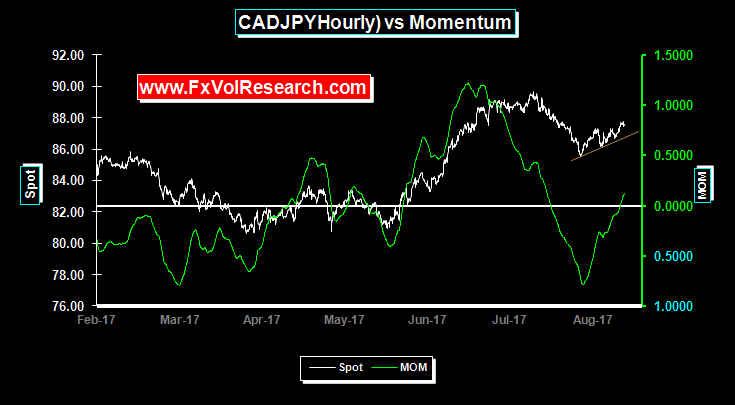

CADJPY momentum turns positive but remains weak.

Dollar Yen momentum is still in mildly negative territory. While the indicators remain mixed on balance they continue to suggest more short term Yen strength.

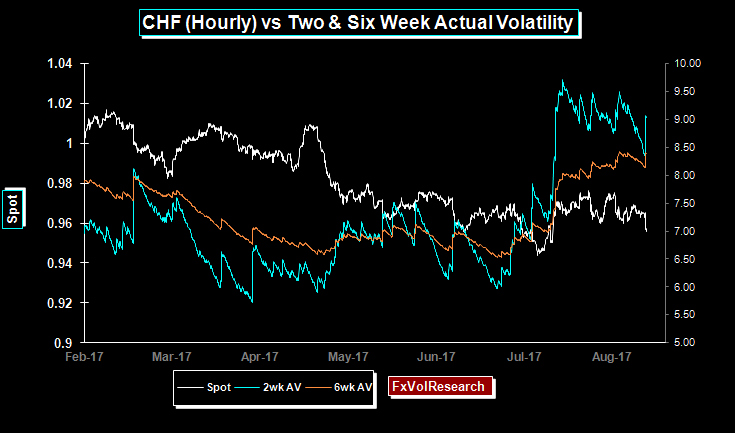

CHF short term actuals remain close to their highs for the year. This is reflected in the percentile rankings of short dated implied CHF vols as well.

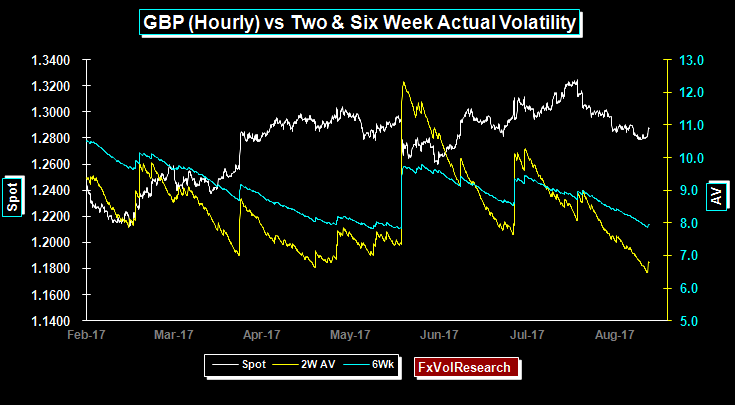

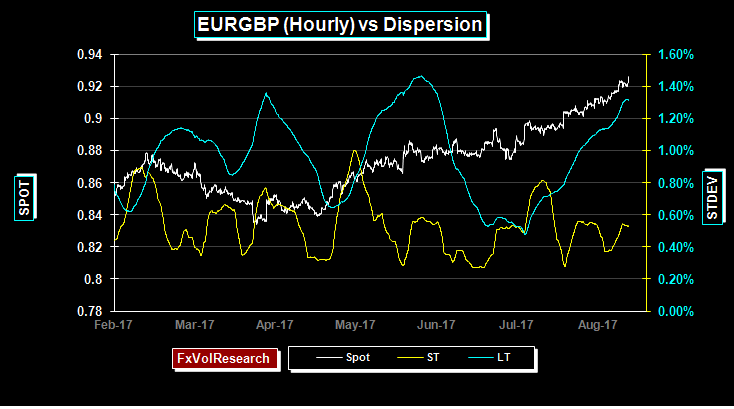

Short term GBP actual vols are testing the lows of the year, and while the spread between short term implied vols and actuals has narrowed it is still in positive territory (implieds>actuals). The Brexit news noted below could well give GBP a boost on Monday.

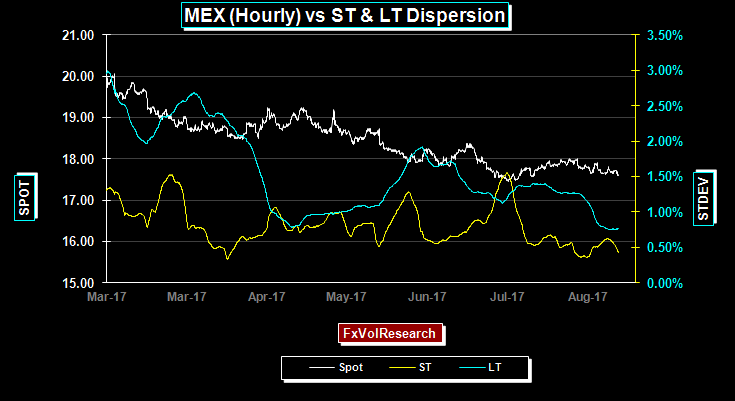

The MXP implied vol curve ticked up very slightly last week and some of our indicators are in the buy zone in terms of percentile rankings. For the moment, the market is ignoring Trump’s threats to shut down the government if he does not get congressional authorization for his border wall. It is unlikely that the Republicans in Congress will succumb to these kinds of threats.

If the Trump Presidency comes to an end, how it ends will really determine the impact on the financial markets. If Trump were to suddenly leave office voluntarily then the impact would be short-lived and be followed by an unwind of the dollar sell off following the French elections. If the Trump Presidency were to lead to a full-scale Constitutional crisis then the dollar downside is far greater and it will leak into the equity markets despite the strong global growth story in the background. Trump has to a large extent been mindful of the advice he has received on matters relating to foreign policy and trade issues. His actions so far have not had far reaching economic implications. However, this may well change if he starts to feel boxed in by a Congress trying asserting its authority over an increasingly unstable executive branch.