Despite China’s slowdown, its currency is now experiencing increased attention and became more important even for the International Monetary Fund, supporting its role in the global trade.

Latest data from the SWIFT RMB Tracker show that the attention, paid to the Chinese yuan, is justified by an increasing use in international transactions, pointing to a rising role of China as a global player.

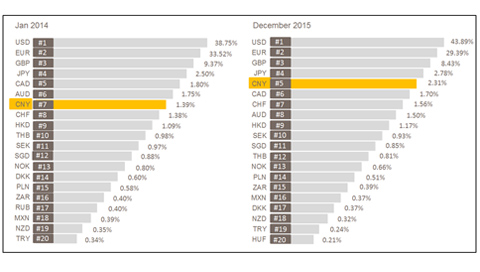

SWIFT published its report for the previous month, where Chinese yuan reached the fifth position, pushing the Canadian dollar and Swiss franc lower.

During the month of December, 2015, yuan reached 2.31% share of global payments in total, rising 0.03% in comparison with the previous month. The Chinese currency has stabilized its fifth position in global transactions and is expected to rise further and gaining more attraction as the Japanese yen, reaching 2.78% global share.

Top three – mostly used currencies – are still the US dollar (43.89%), the Euro (29.39%) and the British pound sterling (8.43%).

But who is using China’s currency so much? SWIFT has reported, that yuan use was rising in the countries like the United Arab Emirates and Qatar. The UAE’s use of the Chinese yuan accounted for 74% of payments by value to China and Hong Kong, up 52% from 2014 levels. In Qatar, the RMB was used for 60% of all payments, a jump of 247% compared to 2014.

Nevertheless, Gulf still remains territory of an US influence, performing most of its payments, even between Arabic state and China or Hong Kong in US dollars, using USD clearing banks as intermediaries.

Sido Bestani, Head of Middle East, Turkey and Africa at SWIFT stated:

“Use of the yuan has been rising across the Middle East region over the last few years. Adoption has been supported by developments such as the establishment of an RMB clearing centre in Qatar last year – the first in the Middle East – and the recent memorandum of co-operation signed between the People’s Bank of China and the Central Bank of the United Arab Emirates to set up RMB clearing arrangements in the UAE. We anticipate these and similar efforts will continue to drive RMB adoption across the region.”

For any questions or recommendations, feel free to write us on hello@goforex.eu